Banking

General Guidelines

Regardless of which bank you choose, you will need to follow the following procedures:

- Bring your Employment Gold Card and another proof of your identity (passport).

- Go to a bank near the address stated on your Employment Gold Card. For example, you cannot go to Xinyi to open a bank account if your residential address is at Sanchong.

- Prepare a local Taiwan number. This is needed for most banks to send OTP for login to your internet banking portal.

Common features for all banks:

- Support multi-currency

- When receiving funds from overseas, every banks is legally required to call you to know the nature of those funds.

- All interest you’ll receive from bank accounts in Taiwan will get automatically reported to the Tax office

Bank Accounts

CTBC Bank

Minimum Deposit: You need to have bring along 1000 NTD for minimum deposit.

Global Transfers: The bank charges 400 NTD administrative fees for any incoming foreign currency transfer into your bank account, regardless of amount. There’s usually fees on the outgoing transfer from your foreign bank too, so your total fees might be more than 400 NTD.

The incoming foreign currency fee can be waived once a month if you have 500,000 NTD in the bank account.

User Interface: CTBC has internet banking on the web and mobile app. It provides the user interface in English and Traditional Chinese. It is quite user-friendly for your day-to-day usage.

E-Sun Bank

PayPal: If you want to use PayPal, only E-Sun can be used.

Fubon Taipei Bank

Minimum Deposit: There is no minimum deposit to setup a Fubon bank account.

Global Transfers: The lowest fees for transferring money abroad. They charge $7 USD to receive USD SWIFT bank transfers (e.g. when transferring money using Revolut or TransferWise).

User Interface: Accepts international numbers for SMS confirmations (2FA). Has an English website (but old). Mobile app in Chinese only.

Foreigner Friendly: Depends on the branch. Most branches seem to have at least some English speaking staff.

Multi-Currency: Yes

Debit Card: Yes

Mega Bank

User Interface: Limited to Personal Account access. No access to business account before 6 months. English interface available.

Citi Bank

Foreigner Friendly: Appointment process could take a month, without guarantee to open an account. If you are interested in their “Citibank® Global Transfers”, it’s only for Taiwanese citizens.

HSBC

Global Transfers: 3,000,000 NTD for their Premier account, and 500,000 NTD for their Advance account.

Supports global transfers from other countries and local transfers.

Transferring Money to Taiwan

Revolut

With a Revolut account, you can easily and cheaply transfer money to a Taiwanese bank account. Note that Revolut does not support NTD as a currency, so you have to transfer USD, which means that your Taiwanese bank account needs to support USD.

Revolut charges 0.5% for foreign exchange exceeding ~$1000 USD per month. They also charge $3-4 USD for SWIFT transfers. Typically Taiwanese banks will charge a fee on incoming USD transfers (e.g. Fubon charges $7 USD), but they’re USD to NTD rates are usually extremely good.

With a free Revolut account ATM card you can withdraw up to ~$200 USD per month without any fees (after which they charge 2%). Bank of Taiwan and Fubon ATMs work well with Revolut cards and don’t charge any fees. Some other banks may charge a fee!

TransferWise

Similar to Revolut, you can easily and cheaply transfer money to a Taiwanese bank account using TransferWise. Note that TransferWise does not support NTD as a currency, so you have to transfer USD, which means that your Taiwanese bank account needs to support USD.

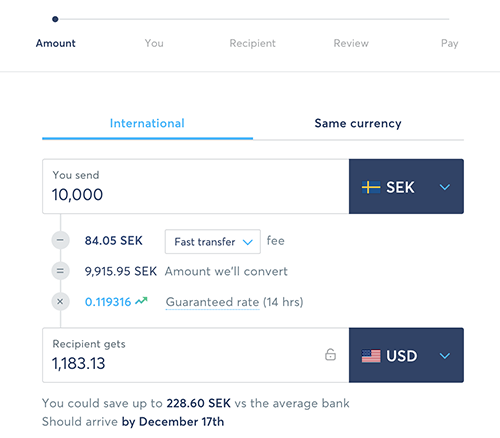

TransferWise charges $3.2 USD for SWIFT transfers. Their foreign exchange rate is roughly similar to Revolut.

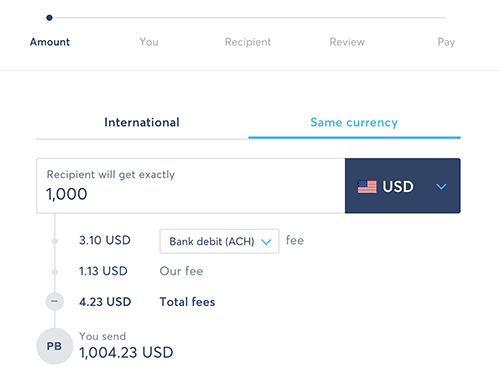

If you’re source/sender currency is USD then you have to create a Same-Currency transfer and select USD.

If you’re source/sender currency is not USD then you have to select “International” and select USD as the recipient currency.

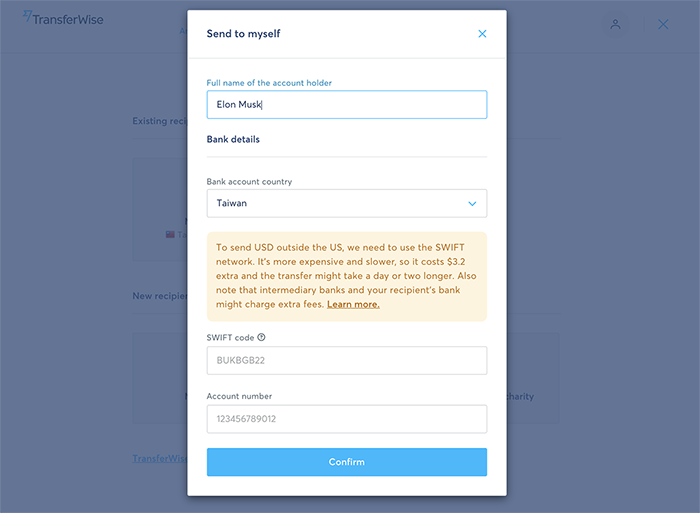

Continue to the Recipient step and create a new Recipient. Select Taiwan and fill out the SWIFT code and Account number for your Taiwanese bank account.